COBRA allows you to extend your previous employers health insurance coverage but the employer no longer helps you pay for the plan. If an employer owes the fee because they didnt cover workers its a flat 2000 per full-time employee excluding first 30 employees.

Reference Based Pricing Health Insurance Group Health Insurance Group Health Health Insurance Cost

Reference Based Pricing Health Insurance Group Health Insurance Group Health Health Insurance Cost

Similarly Situated Individuals While distinctions cannot be based on any of the health factors listed above employers may provide different health benefits to different groups of employees so long as the individuals are not similarly situated individuals.

Can my employer offer a health insurance plan to some workers but not others?. Employer contribution is the insurance industry way of describing the amount an employer pays towards an employees medical insurance. According to the Kaiser Family Foundation less than a third of US businesses with fewer than 50 employees provide health insurance to their employees. In short no there is no good way for you not to offer coverage.

The portion that the employer pays is not included in the employees income and the portion that the employee pays is taken out of their check pre-tax. I recently learned that some of my coworkers have health insurance but I dont. The Affordable Care Act only requires employers to offer health insurance benefitsto employees who work at least 30 hours per weekif they have 50 or more employees.

A small business has no obligation to offer health insurance to part-time employees usually defined as employees who work less than 30 hours per week. Until now the answer has generally been no. Two common ones are full-time versus part-time and salaried versus hourly.

Yes at this time an employer does not have to offer health insurance coverage to all employees. Under the Affordable Care Act employers cant reimburse an employee for non-group health insurance and treat it as offering benefits and complying with the mandate. If youre a small business owner the answer depends on if you decide to offer health insurance to your employees.

If an employer offers a group health plan then California state law requires an employer to contribute a minimum amount towards the cost of the employees medical insurance. 4 Many of them do of course. You have to pay the entire amount for health insurance coverage which can be substantial.

So an employer who must comply with the mandate can offer increased compensation but cant treat it has a qualifying arrangement unless they offer a group plan. Can my employer offer a health insurance plan to some workers but not others. Some of these benefits can include the following.

But 96 of employers in the US have fewer than 50 employees and are thus not required to offer health benefits to their workers. In general employers are free to offer health insurance to some groups of employees and not others as long as those decisions are not made on a discriminatory basis. The rule that applies here is that coverage must be offered to reasonably all which is 95 of eligible workers.

Yes employers are not under obligation to health insurance to all their employees. Employees look for the benefits When a company is hiring they may find that they get a better selection of candidates applying for the job if they offer employee health benefits to those who work for them. Like other workplace benefits your employer can decide to offer health insurance to some employees and not to others as long as the decision to do so was not made based on discrimination.

Yes at this time an employer does not have to offer health insurance coverage to all employees. It can choose to provide coverage based on employment-based categories such as full-time versus part-time workers or salary versus hourly workers. But employer-sponsored health benefits are nearly always provided on a pre-tax basis.

Can my employer offer a health insurance plan to some workers but not others. However if an employer offers insurance to at least one part-time employee then the small business must offer group coverage to all part-time employees. By offering health coverage you can gain a competitive edge over other small businesses.

In comparison almost 97 of companies with 50 or more employees offer it. Businesses with fewer than 50 full-time employees arent required to offer health coverage although many do because good health insurance is an attractive benefit for employees. The ACAs premium tax credit for individual market enrollees helps to level this playing field a bit.

There are many variations of the question posed in the title of this article but the question basically is whether an employer can provide differentbetter health benefits to certain employees usually managers or executives than to others or can provide the same benefits to all employees but charge managers or executives less for the same benefits. A lot of times people who have a better education and better resumes will hold out. It is possible for an employer to legally offer health insurance to some employees and not others using employment-based classifications.

COBRA insurance typically covers employees who worked at companies with at least 20 employees. An employer-payment plan is a type of account-based plan that provides an employee reimbursement for all or a portion of the premium expense for individual health insurance coverage or other non-employer hospital or medical insurance. The key legal criteria though is that all employees within the same employment classification must be treated consistently.

Pin By Gnade Insurance Group On Open Enrollment Health Care Services Open Enrollment Health Plan

Pin By Gnade Insurance Group On Open Enrollment Health Care Services Open Enrollment Health Plan

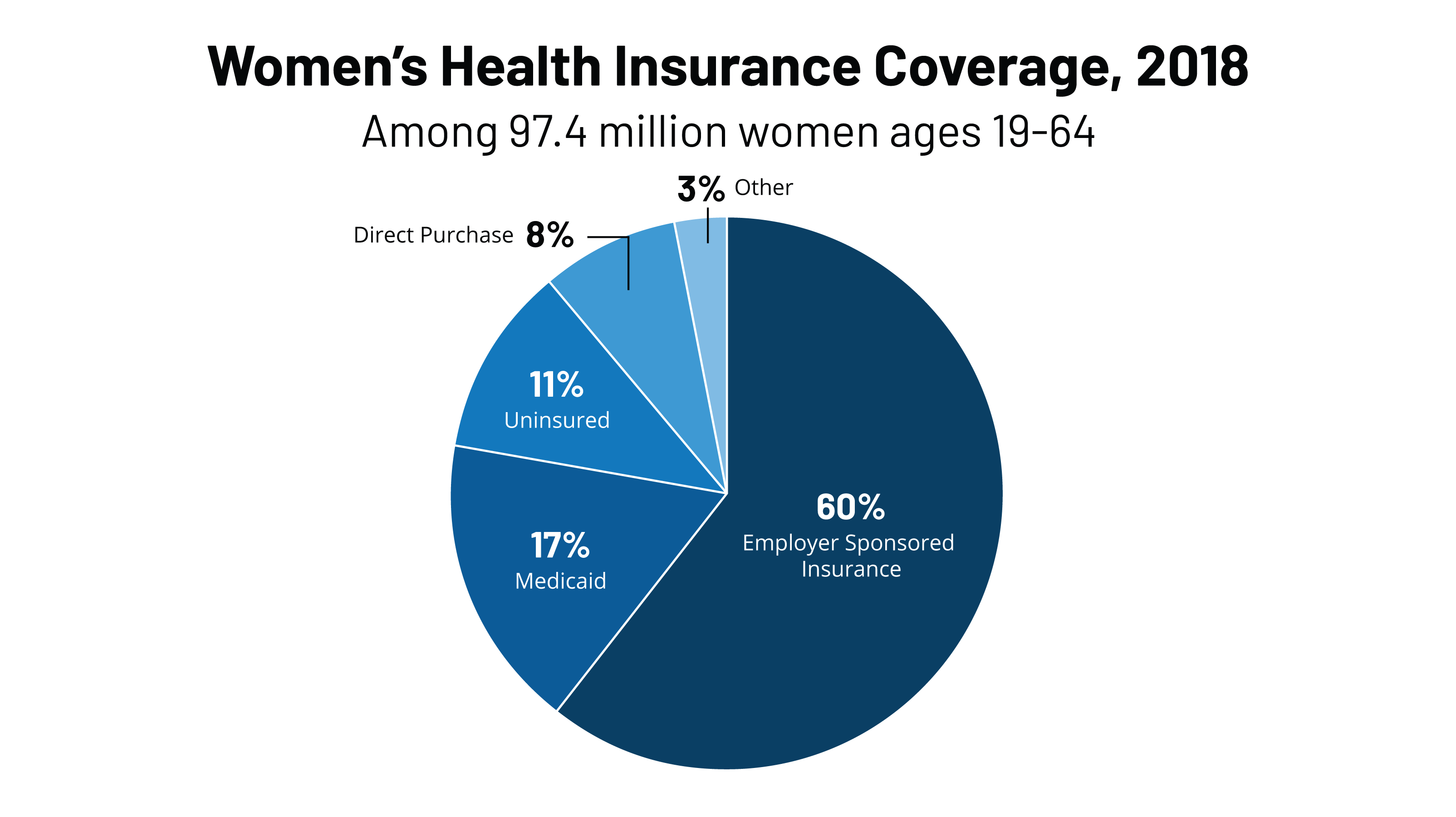

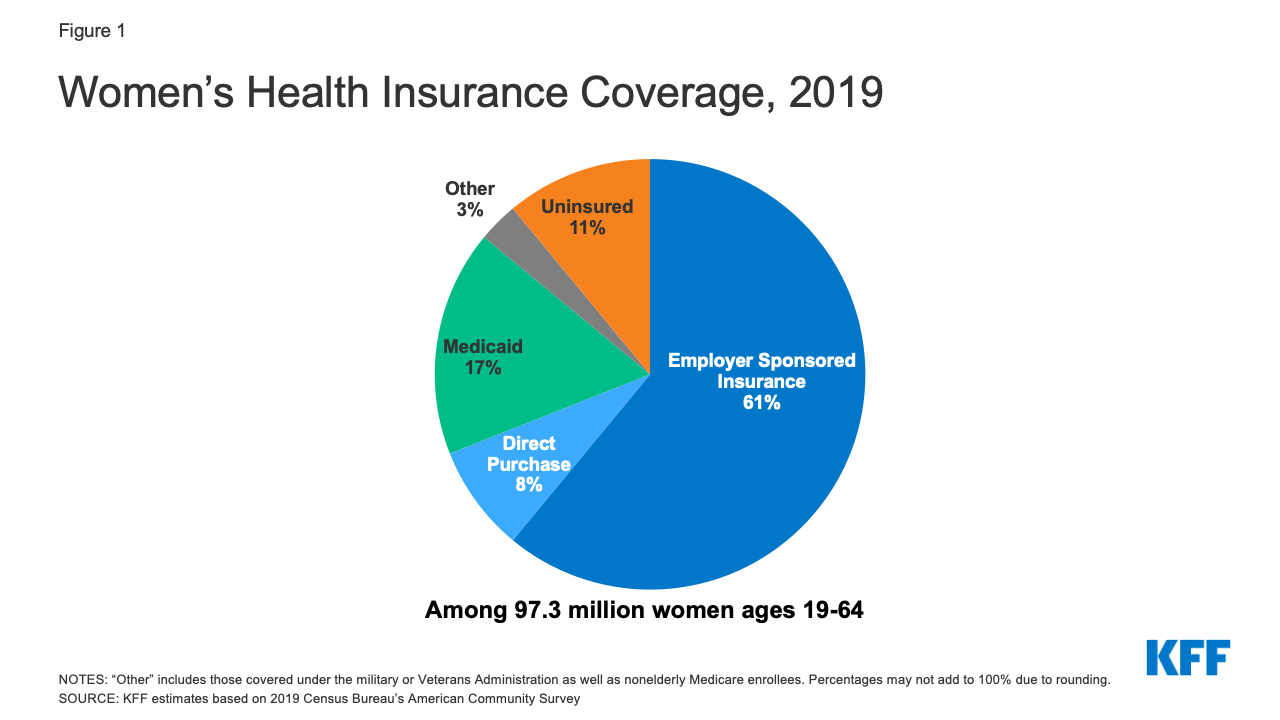

Women S Health Insurance Coverage Kff

Women S Health Insurance Coverage Kff

Small Business Health Insurance Options Health Insurance Options Health Insurance Health

Small Business Health Insurance Options Health Insurance Options Health Insurance Health

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

Explaining Health Care Reform Questions About Health Insurance Subsidies Kff

Explaining Health Care Reform Questions About Health Insurance Subsidies Kff

Group Health Plans 101 Group Health Insurance Health Insurance Broker Group Health

Group Health Plans 101 Group Health Insurance Health Insurance Broker Group Health

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

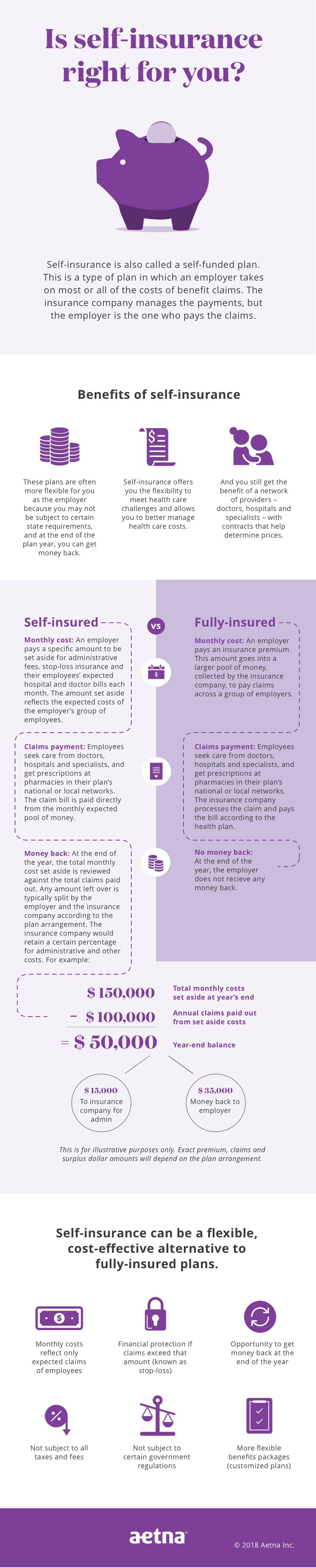

Self Funded Insurance Plans 101 Self Insured Vs Fully Insured Health Plans Aetna

Self Funded Insurance Plans 101 Self Insured Vs Fully Insured Health Plans Aetna

![]() Tracking The Rise In Premium Contributions And Cost Sharing For Families With Large Employer Coverage Peterson Kff Health System Tracker

Tracking The Rise In Premium Contributions And Cost Sharing For Families With Large Employer Coverage Peterson Kff Health System Tracker

Employer Responsibility Under The Affordable Care Act Health Insurance Coverage Family Foundations Health

Employer Responsibility Under The Affordable Care Act Health Insurance Coverage Family Foundations Health

Employee Benefits Fact Sheet For Employers Employee Benefit Fact Sheet Group Health

Employee Benefits Fact Sheet For Employers Employee Benefit Fact Sheet Group Health

Legal Insurance Plans Benefit Employees Employers Legal Insurance Employee Insurance How To Plan

Legal Insurance Plans Benefit Employees Employers Legal Insurance Employee Insurance How To Plan

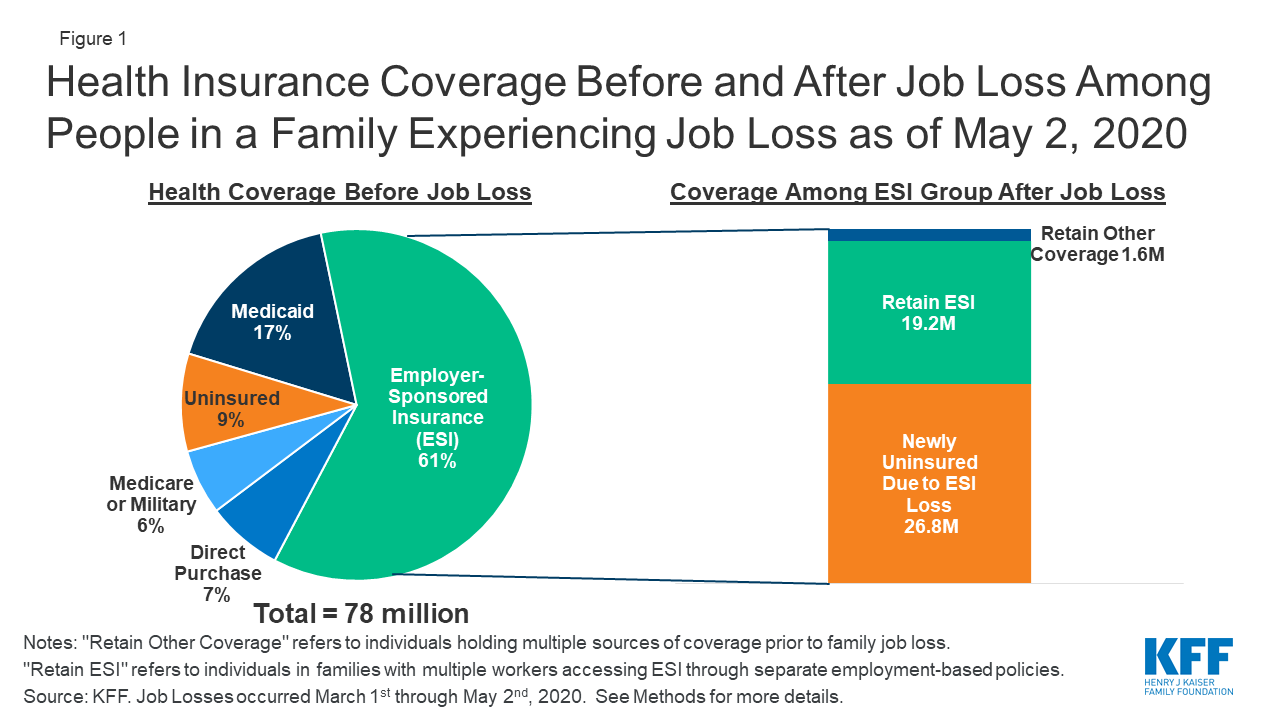

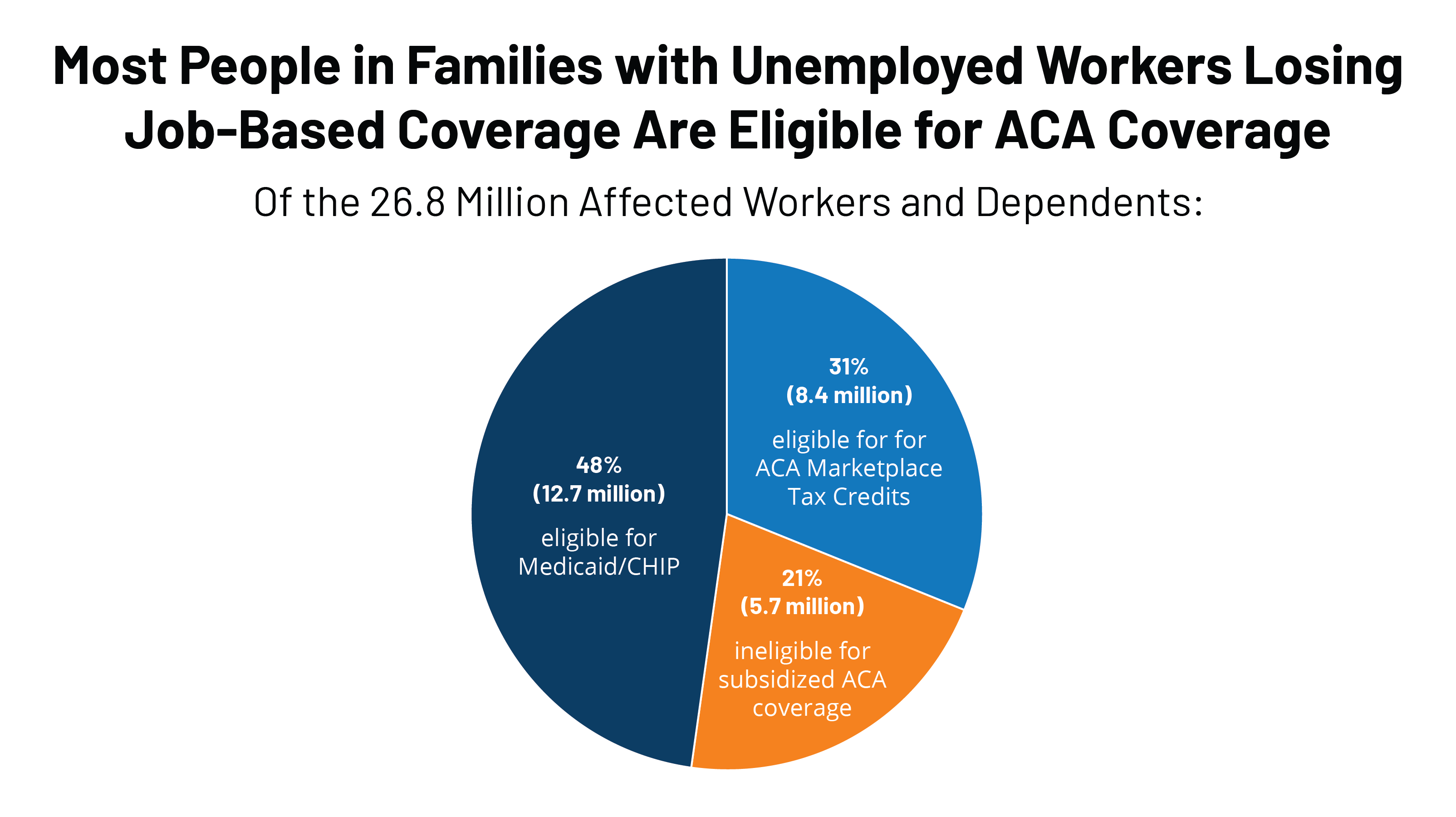

Eligibility For Aca Health Coverage Following Job Loss Kff

Eligibility For Aca Health Coverage Following Job Loss Kff

Eligibility For Aca Health Coverage Following Job Loss Kff

Eligibility For Aca Health Coverage Following Job Loss Kff

Women S Health Insurance Coverage Kff

Women S Health Insurance Coverage Kff

Importance Of Health Insurance Martinowest Ca 95661 Health Insurance Benefits Health Insurance Plans Health Insurance Benefit

Importance Of Health Insurance Martinowest Ca 95661 Health Insurance Benefits Health Insurance Plans Health Insurance Benefit

Health Insurance For 1099 Employees Health For California

Health Insurance For 1099 Employees Health For California

Employee Benefits Fact Sheet For Employers Employee Benefit Fact Sheet Group Health

Employee Benefits Fact Sheet For Employers Employee Benefit Fact Sheet Group Health

Understanding Your Health Insurance Id Card The Daily Dose Cdphp Blog

Understanding Your Health Insurance Id Card The Daily Dose Cdphp Blog

0 Comments